does instacart take taxes out of paycheck

June 5 2019 247 PM. There will be a clear indication.

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Part-time employees sign an.

. Plan ahead to avoid. Does Instacart take out taxes for its employees. Everyone out there serving for.

W-2 employees also have to pay FICA taxes to the tune of 765. Fees vary for one-hour deliveries club store deliveries and deliveries under 35. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them. Everybody who makes income in the US.

Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. The amount they pay is matched by their employer. Instacart shoppers are contractors so the company will not deduct taxes from your paycheck.

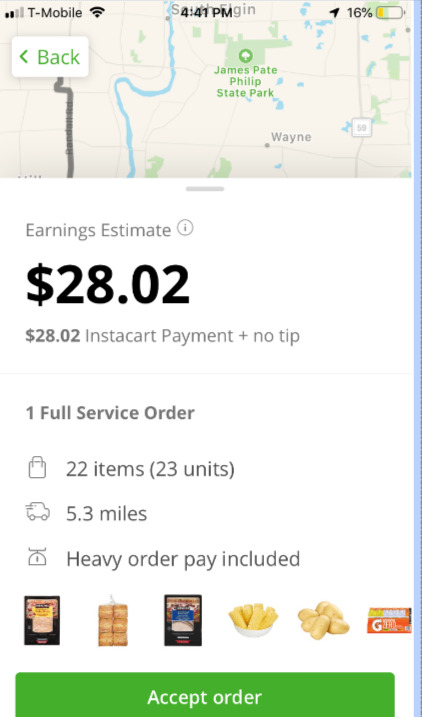

Instacart delivery starts at 399 for same-day orders over 35. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. Youll include the taxes on your.

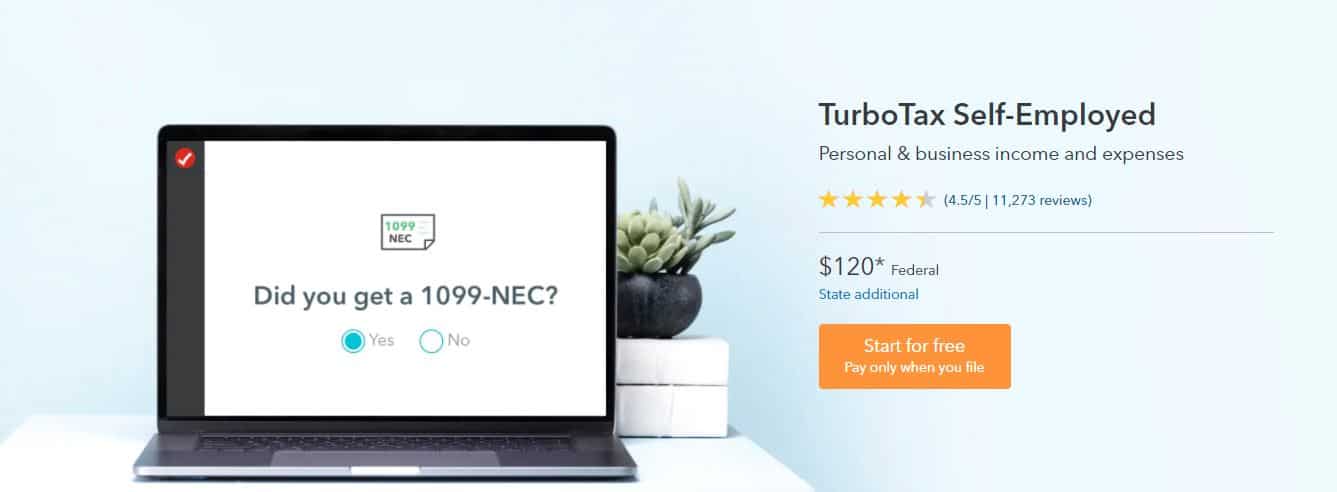

These are contributions that you make before any taxes are withheld from your paycheck. If you make more than 600 per tax year theyll send you a 1099-MISC tax form. The Instacart 1099 tax forms youll need to file.

This is a standard tax form for contract workers. Does Instacart take out taxes for its employees. Instacart does not take out taxes for independent contractors.

Does Instacart take taxes out. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. Has to pay taxes.

Instacart gives people the opportunity to sell their own products and get paid every single day if they want. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. Does Instacart take out taxes for its employees.

For most Shipt and Instacart shoppers you get a. The IRS establishes the. You can save 25 to 30 of every payment and put it in a different account to.

Youll include the taxes on your Form 1040 due on April 15th. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security. As an independent contractor you must pay taxes on your Instacart earnings.

Yes Instacart takes out tax and it means we can help you manage your. No taxes are taken out of your Doordash paycheck. You pay 153 SE tax on 9235 of your Net Profit greater than 400.

As an Instacart driver though youre self-employed. If you pay attention you might have noticed they dont take that much out of your paycheck.

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

When Does Instacart Pay Me The Complete Guide For Gig Workers

What Percent Of Taxes Should I Withhold From My Instacart Revenue Quora

When Does Instacart Pay Me A Contracted Employee S Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

How To Become An Instacart Driver Earn Extra Income

What You Need To Know About Instacart 1099 Taxes

How Much Do Instacart Shoppers Make The Stuff You Need To Know

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com